Burglary Insurance for Businesses

Burglary insurance is a type of insurance that provides coverage for losses and damages resulting from theft and break-ins. It is essential for businesses to invest in such insurance as businesses sometimes deal with many valuable inventory and cash, it can protect their property, assets, and operations from potential losses caused by criminal activities.

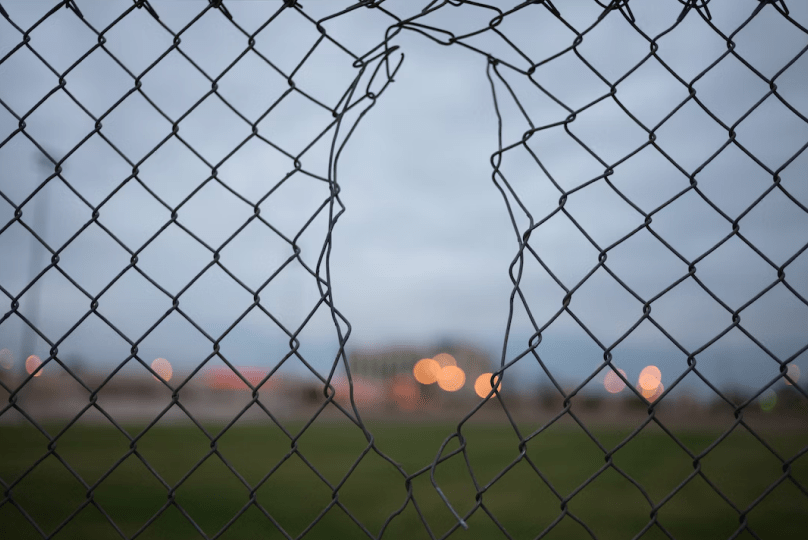

Burglary Insurance helps you keep your premises secure .

Loss of capital

Damage incurred

Learn more about Burglary Insurance for your business:

With the burglary coverage, you will be able to make a claim if anything were to happen to your assets because of a burglary. It covers loss or damage due to theft and/or robbery of your stock in trade, office equipment, and other contents, including damage to your premises.

Should there be any unforeseen accidents, such as burglary, having this coverage will enable the business to claim their sum insured limit for the damages to the premises, their machinery, office equipment, and their stocks and inventories.

With every business, there are different risks involved. Whether or not the business owners have identified these risks or outsourced them, they exist. A business owner can choose to self-insure, which may set back their capital, or obtain the right insurance coverage, which could benefit them and their business.

Yes, please contact us at our call centre to obtain an endorsement should you need to add on any coverages as your business grows and its risks change.

Get an estimate of your business insurance cost

Coverage starting at

RM25/mo

Get covered fast in 10 minutes or less!

Coverage that grows with you and easy monthly payments

Do it all 100% online or talk to a licensed advisor in your region